colorado springs auto sales tax rate

Total Sales Tax Rate. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local.

Colorado Dmv Overtaxed 100k People Last Month

4 rows Colorado Springs CO Sales Tax Rate.

. While Colorado law allows. Line 4 multiplied by 10 X 010 equals Auto Rental Tax due to the City of Colorado Springs. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is.

The average cumulative sales tax rate in Colorado Springs Colorado is 724. A state tax rate of 29 applies to all car sales in Colorado but your total tax rate will include county and local taxes as wellwhich may add up to 8. The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado.

The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax. Aurora CO Sales Tax Rate. Multiply the sum on line 4 by the tax rate effective for the period of the return.

With local taxes the total sales tax rate is between 2900 and 11200. This document lists the sales and use tax rates for all Colorado cities counties and special districts. This includes the rates on the state county city and special levels.

Exact tax amount may vary for different items. If the address is located within the City of Colorado Springs city tax is due on the purchase. The colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104.

With local taxes the total sales tax rate is between 2900 and 11200. Boulder CO Sales Tax Rate. The Colorado sales tax rate is currently.

Colorado Springs is located. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state. All applicable sales andor use taxes must be paid before the Department or any county clerk acting as the Departments authorized agent may issue a certificate of title.

Brighton CO Sales Tax Rate. Download all Colorado sales tax rates by zip code. Sales Tax 50000 - 10000 029 Sales Tax 1160.

Remember that the total amount you pay for a. 4 rows Colorado Springs CO Sales Tax Rate. Arvada CO Sales Tax Rate.

The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. Colorado collects a 29 state sales tax rate on the purchase of all vehicles. Colorado collects a 29 state.

Sales Tax is applied to the purchase of a vehicle by a business in the same manner that it is. The colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. All PPRTA Pikes Peak Rural Transportation Authority.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. Download all Colorado sales tax rates by zip code. This is the total of state county and city sales tax rates.

27 lower than the maximum sales tax in CO. It also contains contact information for all self-collected jurisdictions.

1480 Ainsworth St Colorado Springs Co 80915 Loopnet

3650 Jeannine Dr Colorado Springs Co 80917 Loopnet

How Colorado Taxes Work Auto Dealers Dealr Tax

Used Cars For Sale In Colorado Springs Mike Maroone Automotive Group

Arkansas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Used Preowned Dealer Phil Long Valucar Motor City Academy In Colorado Springs Co

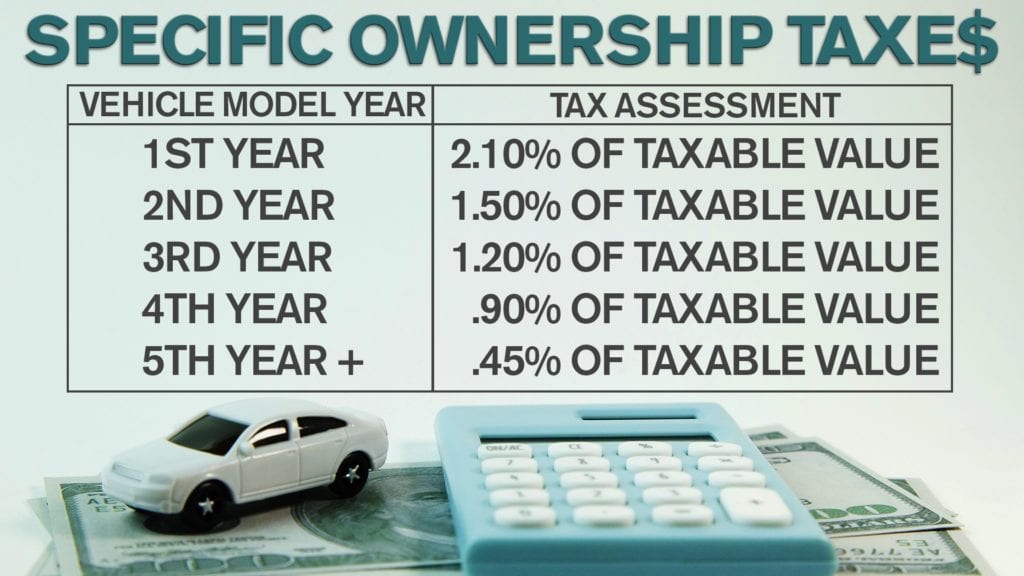

Taxes And Fees Department Of Revenue Motor Vehicle

Buy Used Porsche 911 Gt3 Rs 4 0 At Porsche Colorado Springs

Deal Analysis Return On Equity On A 3 Bed 1 Bath Single Family Rental In Colorado Springs Denver Investment Real Estate

Mercedes Benz Of Colorado Springs New Mercedes Benz Dealership In Colorado Springs Co

Car Tax By State Usa Manual Car Sales Tax Calculator

Used Car Dealer In Colorado Springs Co 80909 Drivetime

Drury Inn Suites Colorado Springs Near The Air Force Academy Drury Hotels

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Colorado Tax Info Pagosa Springs Chamber Of Commerce

New Bmw Specials Winslow Bmw Of Colorado Springs

Used Cars For Sale In Colorado Springs Co Buy Here Pay Here Carhop